Chinese iron ore futures are ripping higher

From:2018-10-25

Ezra Shaw/Getty Images

Iron ore spot markets began to move on Monday as Chinese markets reopened following a week-long holiday.

Mid and higher iron ore grades slightly rose while lower grades fell heavily.

Dalian iron ore futures surged during Monday’s night session, pointing to early strength in spot markets on Tuesday.

Iron ore markets stirred from their slumber on Monday, coinciding with the resumption of trade in China following a week-long holiday.

Gains were recorded across mid and higher grades, masking weakness in cheaper, lower grade ores.

However, with Dalian iron ore futures ripping higher in overnight trade on Monday, it looks like all grades may start on a firmer footing on Tuesday.

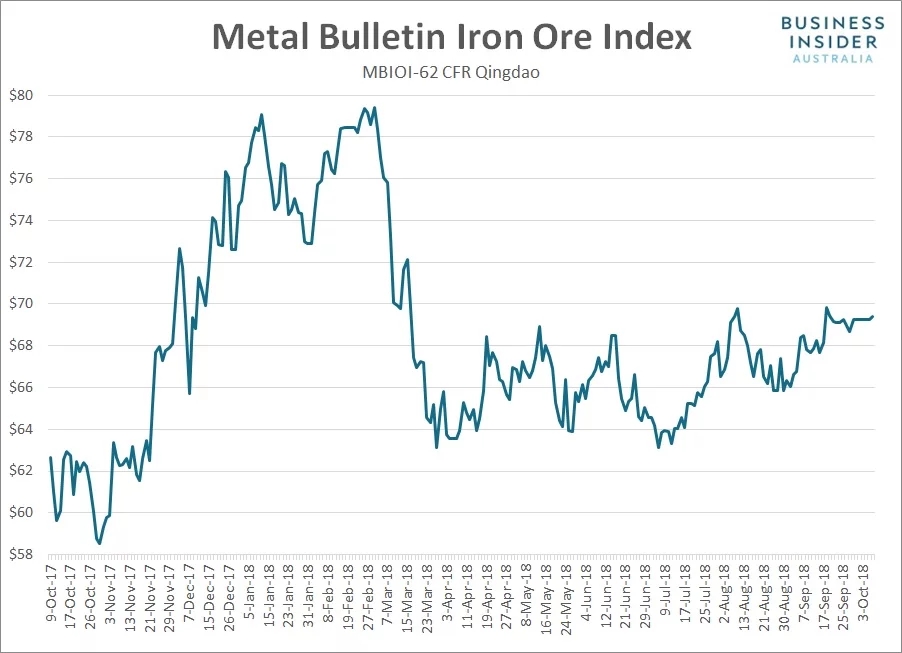

According to Metal Bulletin, the spot price for benchmark 62% fines rose 0.25% to $69.41 a tonne, registering its first movement in over a week.

Higher grade ore also inched higher with the price for 65% Brazilian fines lifting 0.1% to settle at $96.40 a tonne.

In contrast to the gains in higher grades, the price of 58% fines slumped, falling 1.3% to $40.09 a tonne.

The mixed performance in spot markets followed a volatile session in Chinese steel and bulk commodity futures which resumed trade following National Day holidays.

Rebar and hot-rolled coil futures in Shanghai finished Monday’s day session at 3,971 and 3,891 yuan respectively, up 0.7% and 1.2% from the close of September 28.

Both contracts recovered from earlier losses, helping to support gains in bulk commodity contracts, especially the coal complex.

Coking coal futures in Dalian surged 5.9% to 1,332 yuan while the most actively-traded coke contract jumped 4.2% to 2,331.5 yuan.